Generally speaking, the faster a brand can sell through its inventory, the greater its potential for profitability. after six or more months), that merchandise likely needs to be marked down to clear out your dead stock and bring in new products. Retailers track aging inventory because once an item has reached its threshold and remains unsold (i.e.

#INVENTORY DEFINITION FULL#

A proper valuation also requires the assignment of a cost to the inventory, which usually involves a costing methodology, such as FIFO costing, LIFO costing, or weighted-average costing.Aging inventory is a term for goods that haven’t sold quickly or haven't sold for their full retail price. Inventory Valuation ActivitiesĬreating a proper valuation to include on the balance sheet requires either a physical count of the inventory to establish the quantities on hand, or a perpetual inventory system that relies on accurate record keeping of every inventory-related transaction. For that reason, lenders may be reluctant to use it as collateral for a loan. It is one of the least liquid current assets, since it can be difficult to convert into cash. Inventory is considered an asset, and is recorded as such on a company's balance sheet, as a current asset. This inventory is much more difficult to track, since it is off-site. A company may retain ownership of inventory at a retailer or distributor location, with its ownership interest continuing until such time as the inventory is sold. However, from a practical perspective, a company does not usually attempt to account for inventory that is either in transit to it or from it. At the other end of the delivery pipeline, a business also owns inventory until it reaches the customer's receiving dock if it is shipping under FOB destination terms. A business technically takes ownership of inventory if the delivery terms from the supplier are FOB shipping point, which means that ownership passes to the buyer as soon as the goods leave the shipping dock of the supplier. This may be anywhere at a company facility, in trailers in the company parking lot, in leased warehouse space, and so forth. By far the most common of the inventory location types, this is inventory kept in any location that is under the direct control of the business. Inventory can be located in three places, which are: Further, supplier-owned inventory located on the premises should also not be recorded as inventory. Also, customer-owned inventory should not be recorded as inventory owned by the company. Inventory does not include supplies, which are considered to be charged to expense in the period purchased. Examples of merchandise are clothes sold at a retailer, or tires sold at a local automobile repair shop. This is finished goods that have been purchased from a supplier, and which are ready for immediate resale. This is products that have successfully completed the manufacturing process, and are ready for sale. This can be quite a small amount if the manufacturing process is short, or a massive amount if the item being created requires months of work (such as an airliner or a satellite). This is raw materials that are in the process of being transformed into finished products through a manufacturing process. It can literally be "raw" materials that require considerable reconfiguration to become a product (such as sheet metal) or it can be components purchased from a supplier, and which can simply be bolted onto a product that is being assembled.

This is the source material for a company's manufacturing process.

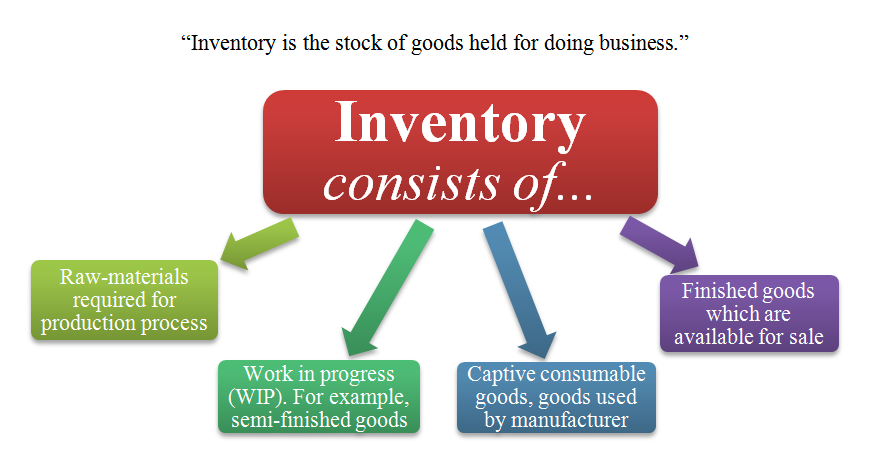

The four components of inventory are noted below. It also acts as a buffer, allowing for the smooth functioning of the production and order fulfillment processes. It is an essential corporate asset, since it is used to generate revenue in many industries. Inventory refers to goods ready for sale or the raw materials used to produce them.

0 kommentar(er)

0 kommentar(er)