After all, it is a loan, right? Essentially, it is not a loan. It might seem confusing to think that your 401(K) loan does not affect your DTI. Why a 401(K) Loan Doesn’t Affect Your DTI Every transaction needs a receipt, which you can give to the lender. In this case, they need proof of receipt of the funds from your 401(K) and then proof of the funds being deposited in your bank account. A loan from your 401(K) does not count against your DTI.Īs a part of the process, your lender will need to see a paper trail following the funds. This means a loan from a bank or even a person that you need to repay. They do this in order to ensure that you did not take out a loan that you need to repay. If it is obvious it is more money than you make at your job, the lender will need proof of the fund’s origination.

This means they need to find out where the funds came from.

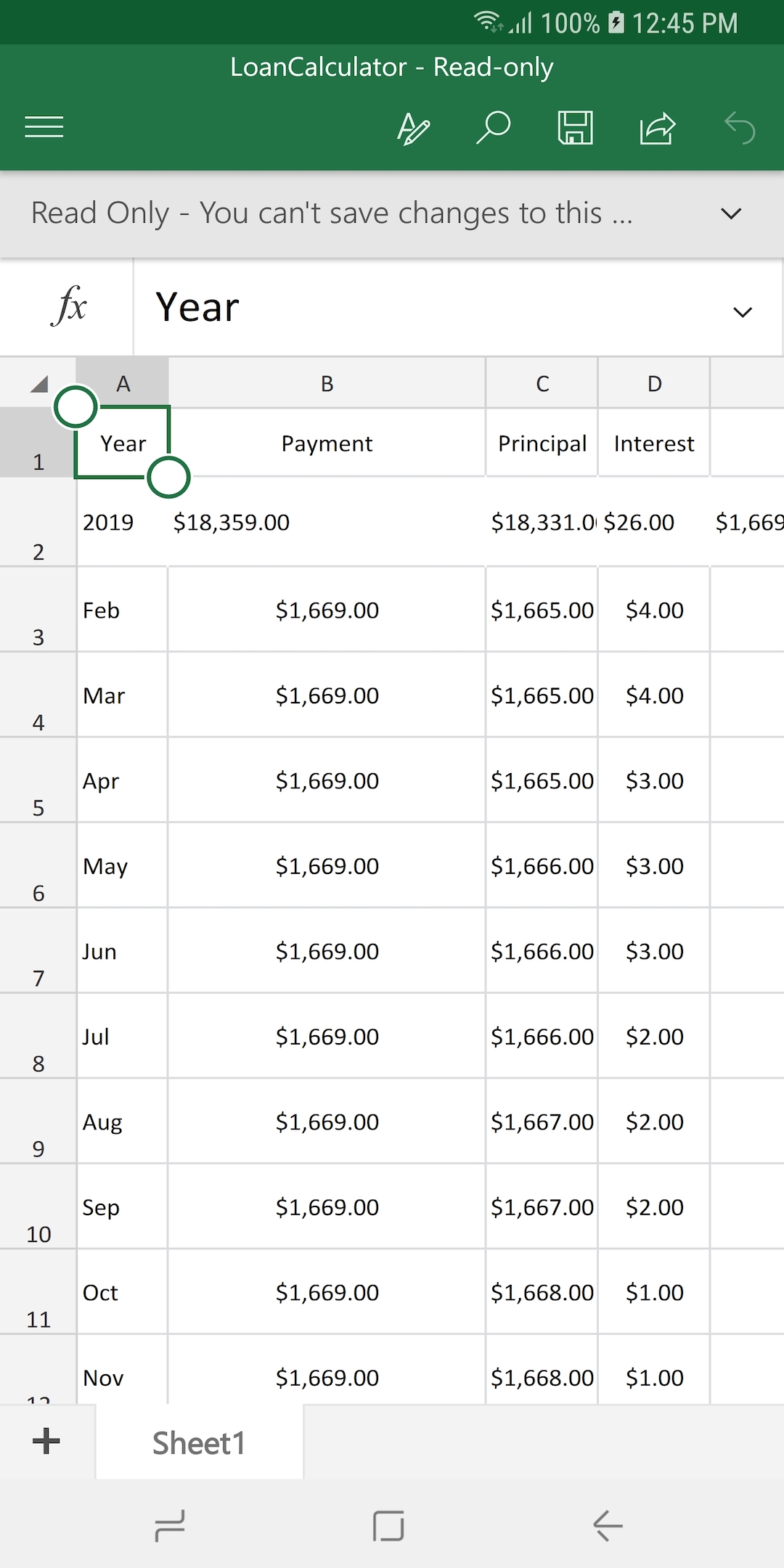

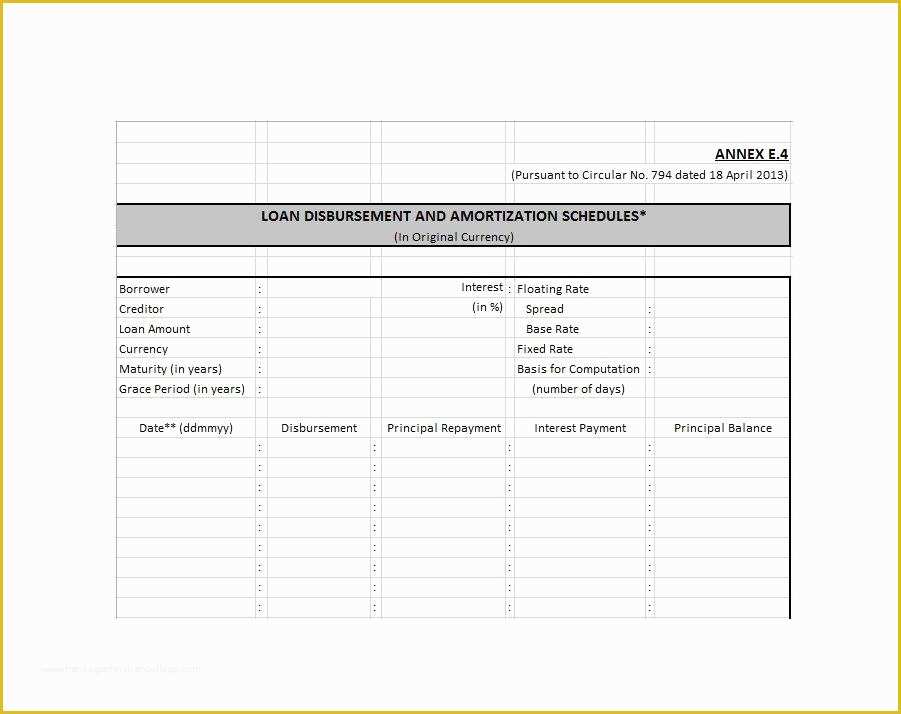

If you use the funds for the down payment on your home, the lender will need to source the funds. This is usually enough to gain approval.Ĭlick to See the Latest Mortgage Rates» Tell Your Lenderĭon’t try to hide the fact that you took out a 401(K) loan from your mortgage lender, though. In order to prove you need the funds to purchase a home, you can simply supply the purchase contract. They have to make sure you are using the funds for an approved purpose. Essentially, though, you are paying yourself back, so it is not as hard of a pill to swallow.īefore you can take out a loan on your 401(K) though, you will probably have to secure approval from the HR administrator at your company. Most companies require you to pay the 401(K) back within 5 years. You can typically expect to pay lower than average interest rates and have a short term. After 5 years, you are able to take out a loan worth up to 50% of the value of your account, according to the law.Įvery company differs on the terms of the 401(K) loan, just like every lender differs on mortgage terms. Let’s say your company requires you to contribute for 5 years before you are fully vested. This means that you held the account for the specific amount of time the company deemed necessary. You must be fully vested in your account, though. One of those reasons is usually to purchase a home. What happens when you want to tap into those funds though? The good news is that many companies allow you to have access to your funds for certain reasons. If your employer matches your contributions, you are in even better position for retirement. If you contribute to your retirement account every time you get paid, you may have quite a bit saved for your golden years. How a 401(K) Loan Worksįirst, let’s look at how you can borrow from a 401(K). Any new debt often increases your debt ratio however, a loan from your 401(K) typically does not affect your DTI. Of course, then you have to worry about your debt-to-income ratio. If you are short on cash, but have a hefty 401(K) account, you might consider taking out a 401(K) loan. On a $200,000 home, this is as much as $10,000 in closing costs. Generally, closing costs span between 2 and 5 percent of the purchase price of the home. Even when you have enough for the down payment, you have to consider the closing costs.

One of the hardest parts about buying a house is saving up for the down payment.

0 kommentar(er)

0 kommentar(er)